Behind the Deal: Company’s decision to go public drawing capital and attention to SA

SEPTEMBER 30, 2022

As published in the San Antonio Business Journal

By: W. Scott Bailey – Senior Reporter, San Antonio Business Journal

The move by bioAffinity Technologies Inc. to pursue an initial public offering has funneled nearly $16 million in new capital into the San Antonio company.

It could also cause investors to take a deeper look at additional bioscience companies in the Alamo City.

The move by San Antonio-based bioAffinity (NASDAQ: BIAF) to pursue an initial public offering began in late 2021.

“We were close at that time to commercialization, and [an IPO] became an option. That’s when we started discussing it and prepared internally,” bioAffinity CEO Maria Zannes said. “We thought we could do well as a public company.”

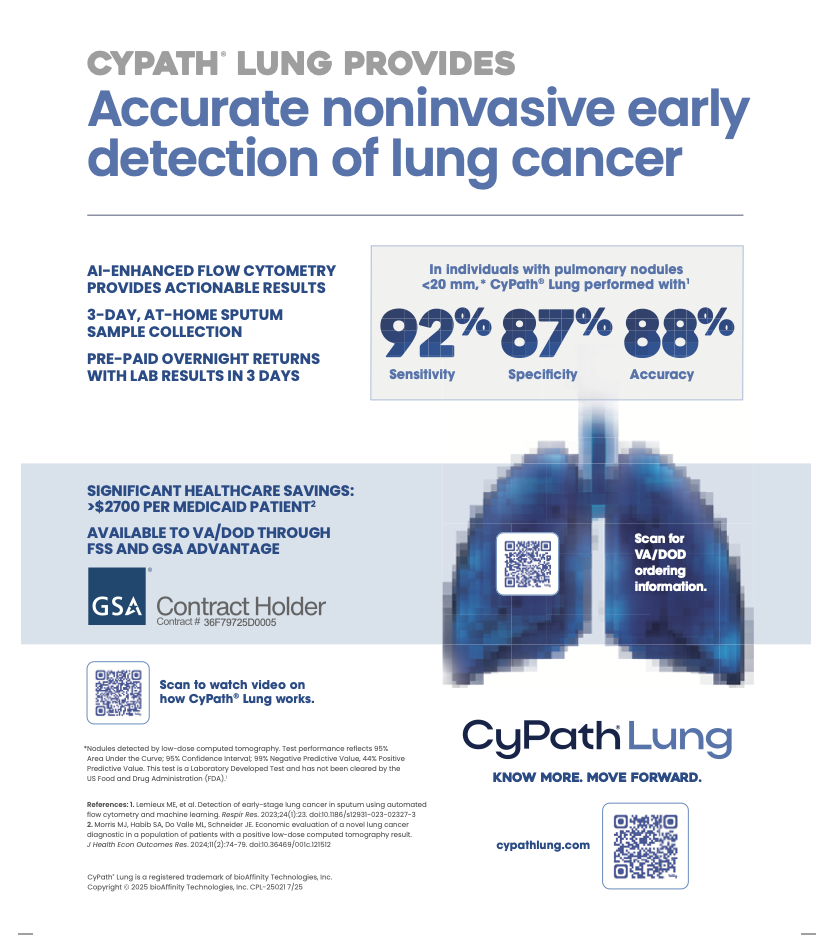

The organization’s public launch is off to a strong start. I reported in early September that bioAffinity had raised nearly $8 million to support the commercialization of its CyPath Lung technology, a noninvasive, early-stage diagnostic to detect cancer and other lung diseases.

It’s since raised a similar amount through additional gross proceeds from the exercise of tradeable and non-tradable warrants tied to the IPO.

That’s roughly the same amount of funding bioAffinity had raised since its inception some eight years ago.

“Being a public company gives you access to capital in ways different than being a private company,” Zannes said. “Having that access to the capital markets is important for a growing company.”

Going public can ultimately impact companies in different ways. Zannes, who will continue to lead bioAffinity, said there was a keen focus by the company’s board and its management to get this right. That included involving bankers, attorneys and auditors who understood the process and what was at stake.

Multiple bioscience industry leaders have noted for years the challenges in luring outside capital to San Antonio. What bioAffinity has accomplished could open more eyes.

“Having a successful IPO, particularly in this market at this time, I hope will bring some attention to what San Antonio can do and the type of types of companies that are thriving here,” Zannes said. “I certainly hope that our success will translate into greater success for the city of San Antonio.”

The momentum could also push bioAffinity forward toward broader commercialization — nationally and internationally. The company already has in place what leadership believes is a strong patent portfolio that presents additional opportunities for growth.

“We appreciate that there are more eyes on us as we move forward,” Zannes said. “We can look globally. And when we reach the milestones that we’ve set for ourselves, that’s when we will be rewarded in the marketplace.”