Expanded, experienced sales team more than doubles number of physician practices ordering CyPath® Lung test year-to-date

More than 547% annualized growth rate for CyPath® Lung orders in first four months of 2024 over full-year 2023, leading to 35% increase in original 2024 forecast

KOL referrals and word-of-mouth expanding adoption of CyPath® Lung outside of the beta market launch in Texas

SAN ANTONIO, Texas (May 15, 2024) – bioAffinity Technologies, Inc. (Nasdaq: BIAF and BIAFW), a biotechnology company focused on the need for noninvasive, accurate tests for the detection of early-stage lung cancer and other lung diseases, today reported financial results for the three months ended March 31, 2024.

Key Highlights

- Generated record quarterly revenue of $2.4 million in the first quarter of 2024.

- Forecasting between $9.2 and $9.6 million in 2024 revenues for wholly owned subsidiary

Precision Pathology Laboratory Services (PPLS), up 23% over 2023. - Increased 2024 CyPath® Lung sales forecast 35% from the original forecast reported in the 2023 Annual Report.

- Number of physician offices ordering CyPath® Lung is up 112%, more than double, since January 1, 2024.

- Medicare reimbursement for CyPath® Lung became effective on January 1, 2024.

- More than 547% annualized growth rate for CyPath® Lung orders in first four months of 2024

over full-year 2023 with April sales showing a robust increase of 21% over the previous month. - Referrals and word-of-mouth from physicians, including key opinion leaders (KOLs), resulting in significant uptake of CyPath® Lung by physicians in states beyond Texas.

- Physicians in Pennsylvania, New Jersey, North Carolina, Arizona, and Michigan are ordering

CyPath® Lung after hearing about it from patients and colleagues. - Medical Director of Lung Innovations Network and The Lung Center at Penn Highlands

Healthcare, Dr. Sandeep Bansal, joined our Medical and Scientific Advisory Board and

incorporated CyPath® Lung into his medical practice that offers comprehensive lung care to over 10,000 patients in central and western Pennsylvania. - Continued to advance new product development initiatives in collaboration with the U.S

Department of Defense’s largest military health organization, focusing on tests that use our

artificial intelligence and flow cytometry platform for diagnosing COPD and companion test with

bronchoscopy. - OncoSelect Therapeutics, a subsidiary of bioAffinity, was awarded a therapeutic patent in India for a novel cancer treatment method using chemotherapeutic agents conjugated to porphyrins.

- Successfully closed a $2.5 million registered direct offering and concurrent private placement to fund continued growth.

Management Commentary

“We are entering a period of accelerating growth with orders for CyPath® Lung up 547% on an annualized basis in the first four months of the year compared to all of 2023,” bioAffinity President and Chief Executive Officer Maria Zannes said. “As we continue to advance our commercial strategy, moving beyond the initial test market in Texas, the unique and compelling attributes of CyPath® Lung, including its AI-enhanced data analysis and non-invasive sample collection, have proven to be key differentiators in the market and are resonating with physicians and patients alike. This growing interest is leading to increased adoption by prominent medical practices and double-digit month-over-month growth in test orders.”

“CyPath® Lung is positioned to set a new standard in the early detection of lung cancer – a market projected to reach $4.7 billion by 2030,” Zannes continued. “As we continue to scale our operations and enhance our offerings, our focus remains steadfast on improving patient outcomes and delivering shareholder value. With Medicare and major private insurers now providing coverage, the pathway for increased adoption and accelerated growth in usage is clear, setting the stage for substantial market penetration and revenue generation in the upcoming quarters.”

First Quarter Financial Results

Revenue for the first quarter of 2024 was $2.4 million, compared with $921 revenue for the prior-year period. The majority of the year-over-year increase is through the acquisition of Precision Pathology Laboratory Services. Revenue is primarily generated from patient service fees, including billing for CyPath® Lung tests, with additional revenues generated from histology service fees and medical director fees.

Research and development expenses were $394,000 for the first quarter of 2024, compared with $370,000 for the comparable period in 2023. The increase was primarily due to higher compensation costs for additional research personnel and higher R&D laboratory supply costs. Clinical development expenses were $49,000 for the first quarter of 2024, compared with $20,000 for the first quarter of 2023. The increase was primarily due to an increase in compensation costs and benefits from the addition of new clinical development personnel.

Selling, general and administrative expenses were $2.2 million for the first quarter of 2024, compared with $1.1 million for the comparable period in 2023. The increase was primarily due to acquired general and administrative costs from PPLS and an increase in personnel and services to support the launch of CyPath® Lung.

Net loss for the first quarter of 2024 was $2.1 million, or $0.21 per share, compared with a net loss of $1.5 million, or $0.18 per share, for the comparable period in 2023.

Cash and cash equivalents as of March 31, 2024, were $2.5 million, compared with $2.8 million as of December 31, 2023.

About bioAffinity Technologies, Inc.

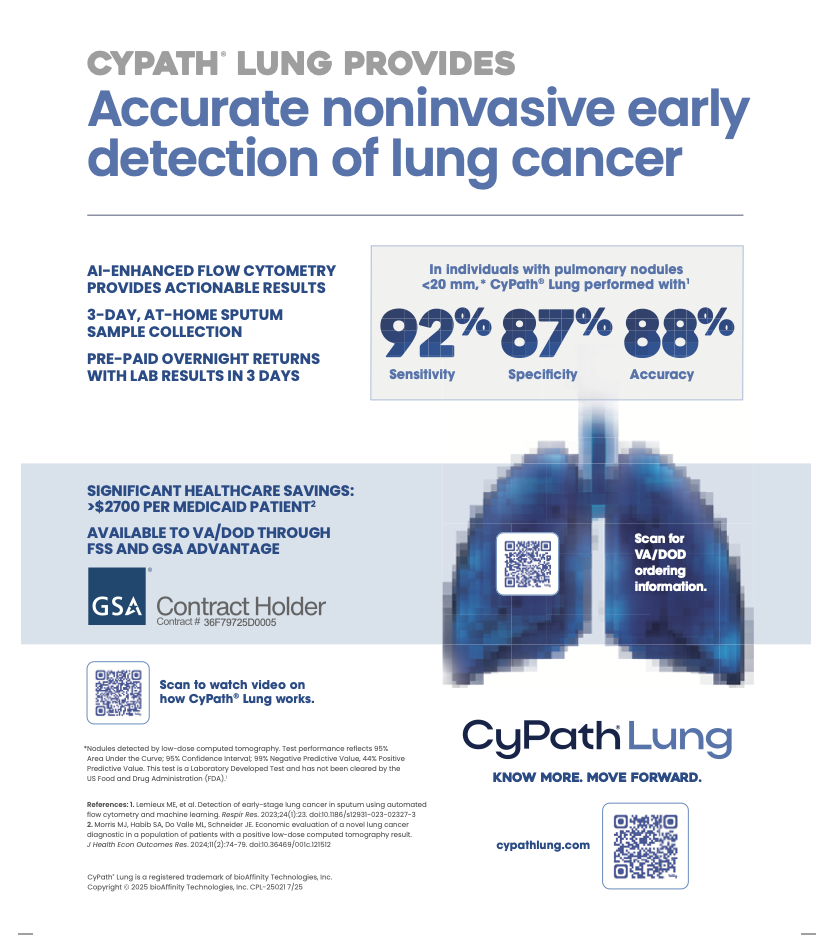

bioAffinity Technologies, Inc. addresses the need for noninvasive diagnosis of early-stage cancer and diseases of the lung and broad-spectrum cancer treatments. The Company’s first product, CyPath® Lung, is a noninvasive test that has shown high sensitivity, specificity and accuracy for the detection of early- stage lung cancer. CyPath® Lung is marketed as a Laboratory Developed Test (LDT) by Precision Pathology Laboratory Services, a subsidiary of bioAffinity Technologies. For more information, visit www.bioaffinitytech.com.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates and assumptions and include statements regarding continuing to advance the Company’s commercial strategy, moving beyond the initial test market in Texas, positioning CyPath® Lung to set a new standard in the early detection of lung cancer – a market projected to reach $4.7 billion by 2030, increased adoption by prominent medical practices and double-digit month-over-month growth in test orders, revised forecast of between $9.2 million and $9.6 million in 2024 revenues for wholly owned subsidiary Precision Pathology Laboratory Services, up 23% over 2023, and the increased 2024 CyPath® Lung sales forecast of 35% from the original forecast reported in the 2023 Annual Report. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to continue to advance the Company’s commercial strategy, moving beyond the initial test market in Texas, the ability to generate revenue forecasted and to generate forecasted 2024 CyPath® Lung sales, and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. Such forward-looking statements are based on facts and conditions as they exist at the time such statements are made and predictions as to future facts and conditions. While the Company believes these forward-looking statements are reasonable, readers of this press release are cautioned not to place undue reliance on any forward-looking statements. The information in this release is provided only as of the date of this release, and the Company does not undertake any obligation to update any forward-looking statement relating to matters discussed in this press release, except as may be required by applicable securities laws.

Contacts

bioAffinity Technologies

Julie Anne Overton

Director of Communications

jao@bioaffinitytech.com

Investor Relations

Dave Gentry

RedChip Companies Inc.

1-800-RED-CHIP (733-2447) Or 407-491-4498

BIAF@redchip.com

bioAffinity Technologies, Inc.

Condensed Consolidated Balance Sheets

March 31, 2024 December 31, 2023

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 2,453,165 $ 2,821,570

Accounts and other receivables, net 1,123,609 811,674

Inventory 9,487 18,484

Prepaid expenses and other current assets 344,900 321,017

Total current assets 3,931,161 3,972,745

Non-current assets:

Property and equipment, net 461,209 458,633

Operating lease right-of-use asset, net 347,860 370,312

Finance lease right-to-use, net 1,069,601 1,165,844

Goodwill 1,404,486 1,404,486

Intangible assets, net 818,889 833,472

Other assets 16,060 16,060

Total assets $ 8,049,266 $ 8,221,552

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ 442,485 $ 604,789

Accrued expenses 923,810 1,149,811

Unearned revenue 30,174 33,058

Operating lease liability, current portion 96,631 94,708

Finance lease liability, current portion 372,787 365,463

Notes payable, current portion 4,686 —

Total current liabilities 1,870,573 2,247,829

Non-current liabilities:

Finance lease liability, net of current portion 739,478 835,467

Operating lease liability, net of current portion 258,110 283,001

Notes payable, net of current portion 23,037 —

Total liabilities 2,891,198 3,366,297

Commitments and contingencies

Stockholders’ equity:

Preferred stock, par value $0.001 per share; 20,000,000 shares

authorized; no shares issued or outstanding at March 31, 2024,

and December 31, 2023 — —

Common stock, par value $0.007 per share; 25,000,000 shares

authorized; 11,214,502 and 9,394,610 issued and outstanding at

March 31, 2024, and at December 31, 2023, respectively. 78,515 65,762

Additional paid-in capital 51,744,830 49,393,972

Accumulated deficit (46,665,277) (44,604,479)

Total stockholders’ equity 5,158,068 4,855,255

Total liabilities and stockholders’ equity $ 8,049,266 $ 8,221,552

bioAffinity Technologies, Inc. Unaudited Condensed Consolidated Statements of Operations

Three Months Ended

March 31,

2024 2023

(unaudited)

Net Revenue $ 2,406,391 $ 921

Operating expenses:

Direct costs and expenses 1,660,007 87

Research and development 393,639 369,617

Clinical development 48,960 19,628

Selling, general and administrative 2,196,361 1,147,875

Depreciation and amortization 149,637 21,684

Total operating expenses 4,448,604 1,558,891

Loss from operations (2,044,213) (1,557,970)

Other income (expense):

Interest income 6,127 38,654

Interest expense (23,550) (1,655)

Other income — —

Other expense 4,510 —

Net loss before provision for income taxes (2,057,126) (4,919,158)

Income tax expense (3,672) (11,819)

Net loss $ (2,060,798) $ (1,532,790)

Net loss per common share, basic and diluted $ (0.21) $ (0.18)

Weighted average common shares outstanding, basic and diluted 9,915,426 8,433,689