CyPath® Lung revenues up 62% year-over-year in first six months of 2025

SAN ANTONIO, Texas (August 14, 2025) – bioAffinity Technologies, Inc. (Nasdaq: BIAF; BIAFW), a biotechnology company focused on providing noninvasive, accurate detection of early-stage lung cancer and other lung diseases, today reported financial results for the three months ended June 30, 2025.

Key Highlights

- Increased CyPath® Lung revenues 62% year-over-year for the six-month period ended June 30, 2025.

- Completed CyPath® Lung tests in July represented a 72% increase over the previous monthly average for the first six months of 2025, including back-to-back record monthly sales in June and July.

- Released real-world case studies demonstrating the diagnostic utility of CyPath® Lung, including successful detection of Stage 1A lung cancers for multiple patients who had previous tests and imaging that incorrectly deemed the risk of cancer as low.

- Increased the list price of CyPath® Lung to $2,900, aligning with private payer reimbursement strategies and enhancing per-test profitability.

- Expanded logistics capabilities through partnership with Cardinal Health™ OptiFreight® Logistics, improving sample tracking, cost efficiency, and national delivery reliability in support of CyPath® Lung’s commercial growth.

- Completed a $3.25 million public offering in May 2025 providing working capital.

- Appointed Dr. Gordon Downie, MD, PhD, as Chief Medical Officer, bringing more than 30 years of clinical leadership in pulmonology and interventional lung care to support bioAffinity’s diagnostic and clinical strategy.

- Announced patent grants in the U.S., China, Canada, and Australia, expanding the Company’s global intellectual property portfolio for both diagnostics and therapeutics, including a newly issued U.S. patent for a broad-spectrum cancer therapy targeting CD320 and LRP2 receptors.

- Presented novel siRNA-based cancer therapy research at the 2025 RNA Therapeutics Conference, showcasing the potential of a new therapeutic approach to selectively kill cancer cells without harming healthy tissue.

- bioAffinity President and CEO Maria Zannes appointed to the American Lung Association in Texas Leadership Board, reinforcing the Company’s advocacy and leadership in lung health and early cancer detection.

Management Commentary

“Our second quarter results reflect the continued acceleration of our CyPath® Lung commercialization strategy, with testing revenue up 62% for the first half of the year,” Maria Zannes, President and Chief Executive Officer of bioAffinity Technologies said. “This growth is driven by increasing clinical adoption of our noninvasive lung cancer diagnostic and supported by physician-authored case studies showing that CyPath® Lung has identified early-stage cancers that other tests missed. These real-world results are validating our test’s unique value in guiding clinical decisions and improving patient outcomes.

“The success of our pilot marketing program in Texas, which has approximately 6% of the total number of U.S. pulmonologists, has demonstrated that our approach to the medical community is sound and effective. We are prepared to meet increased demand as we implement our strategy to enter additional key markets, including our expansion in the Mid-Atlantic region and the Veterans Administration healthcare system.

“During the quarter, we took important steps to strengthen our financial foundation, including a successful $3.25 million public offering and a strategic price adjustment for CyPath® Lung to better reflect its value and align with reimbursement from private payers. At the same time, our partnership with Cardinal Health OptiFreight® Logistics has enhanced our national sample delivery capabilities to meet growing demand.

“We are also proud to have expanded our leadership team with the appointment of Dr. Gordon Downie as Chief Medical Officer. His expertise in pulmonary medicine and lung cancer screening is already shaping our clinical direction, including advancement toward pivotal trials.

“Our intellectual property portfolio continues to grow with newly granted patents in the U.S., China, Canada, and Australia—strengthening both our diagnostic and therapeutic platforms on a global scale. We also presented breakthrough research at the 2025 RNA Therapeutics Conference, showcasing our siRNA-based approach to selectively kill cancer cells while sparing healthy tissue, a strategy with broad potential across multiple tumor types.

“Looking ahead, we remain focused on expanding access to CyPath® Lung, delivering operational efficiency, and advancing the next generation of diagnostics and therapeutics,” Zannes added. “Every test we deliver is a step toward earlier cancer detection, better patient care, and stronger value for our shareholders.”

Second Quarter 2025 Financial Results

Revenue for the quarter ended June 30, 2025, was $1.3 million, compared with $2.4 million for the second quarter of 2024. The decrease was primarily attributable to the Company’s strategic decision to discontinue unprofitable pathology services and reallocate resources toward the commercialization of CyPath® Lung. CyPath® Lung testing revenue for the six months ended June 30, 2025, increased approximately 62% year-over-year to $323,000, reflecting growth in physician adoption and an increase in total test results delivered.

Operating expenses for the second quarter of 2025 were $3.8 million, down 16% from $4.5 million in the second quarter of 2024. The decrease was primarily due to lower direct costs related to laboratory operations and reduced research and development expenses, partially offset by increased clinical development spending in support of the Company’s pivotal trial strategy.

- Direct costs and expenses were $1.0 million, a 28% decrease from the prior-year period, driven by cost-saving initiatives implemented in March 2025.

- Research and development expenses decreased 23% year-over-year to $311,000, reflecting lower compensation and lab supply costs.

- Clinical development expenses increased to $129,000, up from $51,000 in Q2 2024, due to higher professional fees.

- Selling, general and administrative expenses decreased 10% to $2.2 million, largely reflecting efficiencies following the integration of PPLS and adjustments to staffing and support functions.

- Depreciation and amortization expense declined 25% year-over-year to $113,000.

Net loss for the quarter ended June 30, 2025, was $4.1 million, or $0.17 per share, compared with a net loss of $2.1 million, or $0.19 per share, for the second quarter of 2024. The increase in net loss was primarily driven by a $1.5 million increase in non-cash expenses related to warrant remeasurement and offering costs associated with the Company’s May 2025 public offering.

Cash and cash equivalents as of June 30, 2025, were $0.8 million, compared with $1.1 million as of December 31, 2024. bioAffinity Technologies raised aggregate gross proceeds of $3.25 million through a public offering in May 2025.

About bioAffinity Technologies, Inc.

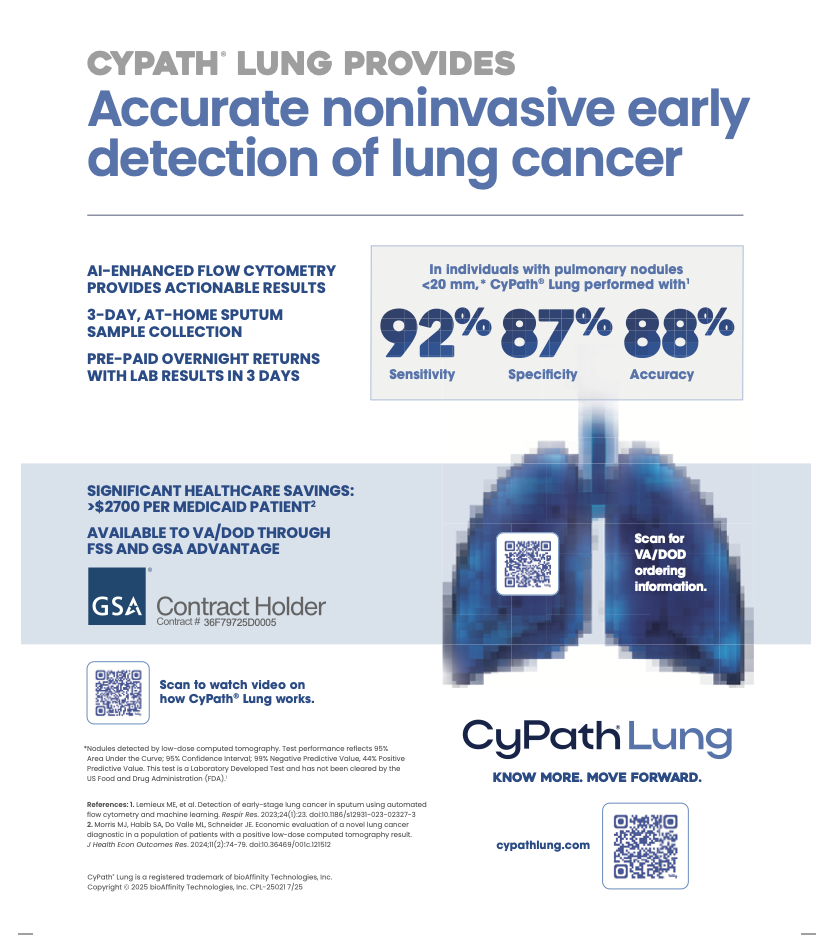

bioAffinity Technologies, Inc. addresses the need for noninvasive diagnosis of early-stage cancer and diseases of the lung and broad-spectrum cancer treatments. The Company’s first product, CyPath® Lung, is a noninvasive test that has shown high sensitivity, specificity and accuracy for the detection of early-stage lung cancer. CyPath® Lung is marketed as a Laboratory Developed Test (LDT) by Precision Pathology Laboratory Services, a subsidiary of bioAffinity Technologies. For more information, visit www.bioaffinitytech.com.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates and assumptions and include statements regarding strategic actions reducing costs while expanding sales focus on high-margin diagnostics like CyPath® Lung; international patents expanding CyPath® Lung’s global commercialization potential; the targeted actions accelerating the commercial growth of CyPath® Lung; patient case studies continuing to underscore the diagnostic power of CyPath® Lung in real-world settings; expanding access to CyPath® Lung for patients at risk of lung cancer; and advancing new diagnostics for diseases like COPD and asthma. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, strategic actions reducing costs while expanding sales focus on high-margin diagnostics like CyPath® Lung; international patents expanding CyPath® Lung’s global commercialization potential; the targeted actions accelerating the commercial growth of CyPath® Lung; patient case studies continuing to underscore the diagnostic power of CyPath® Lung in real-world settings; expanding access to CyPath® Lung for patients at risk of lung cancer; advancing new diagnostics for diseases like COPD and asthma; and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. Such forward-looking statements are based on facts and conditions as they exist at the time such statements are made and predictions as to future facts and conditions. While the Company believes these forward-looking statements are reasonable, readers of this press release are cautioned not to place undue reliance on any forward-looking statements. The information in this release is provided only as of the date of this release, and the Company does not undertake any obligation to update any forward-looking statement relating to matters discussed in this press release, except as may be required by applicable securities laws.

Contacts

bioAffinity Technologies

Julie Anne Overton

Director of Communications

jao@bioaffinitytech.com

Investor Relations

Dave Gentry

RedChip Companies Inc.

1-800-RED-CHIP (733-2447)

Or 407-491-4498

BIAF@redchip.com

bioAffinity Technologies, Inc.

Condensed Consolidated Balance Sheets

| June 30, 2025 | December 31, 2024 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 802,835 | $ | 1,105,291 | ||||

| Accounts and other receivables, net | 421,869 | 1,139,204 | ||||||

| Inventory | 43,971 | 27,608 | ||||||

| Prepaid expenses and other current assets | 400,151 | 422,995 | ||||||

| Total current assets | 1,668,826 | 2,695,098 | ||||||

| Non-current assets: | ||||||||

| Property and equipment, net | 351,368 | 375,385 | ||||||

| Operating lease right-of-use asset, net | 399,879 | 463,011 | ||||||

| Finance lease right-of-use asset, net | 167,730 | 780,872 | ||||||

| Goodwill | 1,404,486 | 1,404,486 | ||||||

| Intangible assets, net | 745,972 | 775,139 | ||||||

| Other assets | 12,814 | 19,676 | ||||||

| Total assets | $ | 4,751,075 | $ | 6,513,667 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 1,169,837 | $ | 987,311 | ||||

| Accrued expenses | 1,048,034 | 1,398,722 | ||||||

| Unearned revenue | 24,404 | 24,404 | ||||||

| Operating lease liability, current portion | 133,239 | 127,498 | ||||||

| Finance lease liability, current portion | 179,844 | 395,301 | ||||||

| Notes payable, current portion | 32,946 | 171,669 | ||||||

| Total current liabilities | 2,588,304 | 3,104,905 | ||||||

| Non-current liabilities: | ||||||||

| Operating lease liability, net of current portion | 274,074 | 342,098 | ||||||

| Finance lease liability, net of current portion | 3,942 | 444,448 | ||||||

| Notes payable, net of current portion | 45,952 | 20,180 | ||||||

| Warrant liability | 3,974,911 | — | ||||||

| Total liabilities | 6,887,183 | 3,911,631 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity (deficit): | ||||||||

| Preferred stock, par value $0.001 per share; 20,000,000 shares authorized; no shares issued or outstanding at June 30, 2025, and December 31, 2024 | — | — | ||||||

| Common stock, par value $0.007 per share; 100,000,000 shares authorized; 28,459,541 and 15,576,674 issued and outstanding at June 30, 2025, and December 31, 2024, respectively | 197,236 | 106,593 | ||||||

| Additional paid-in capital | 58,032,170 | 56,139,753 | ||||||

| Accumulated deficit | (60,365,514 | ) | (53,644,310 | ) | ||||

| Total stockholders’ equity (deficit) | (2,136,108 | ) | 2,602,036 | |||||

| Total liabilities and stockholders’ equity (deficit) | $ | 4,751,075 | $ | 6,513,667 | ||||

bioAffinity Technologies, Inc.

Unaudited Consolidated Statements of Operations

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net revenue | $ | 1,269,483 | $ | 2,397,652 | $ | 3,123,080 | $ | 4,804,043 | ||||||||

| Operating expenses: | ||||||||||||||||

| Direct costs and expenses | 1,016,602 | 1,407,710 | 2,384,462 | 2,981,151 | ||||||||||||

| Research and development | 311,372 | 402,433 | 678,758 | 796,072 | ||||||||||||

| Clinical development | 129,279 | 51,462 | 267,632 | 100,422 | ||||||||||||

| Selling, general and administrative | 2,214,561 | 2,472,775 | 4,667,110 | 4,658,719 | ||||||||||||

| Depreciation and amortization | 113,229 | 151,070 | 267,817 | 300,707 | ||||||||||||

| Total operating expenses | 3,785,043 | 4,485,450 | 8,265,779 | 8,837,071 | ||||||||||||

| Loss from operations | (2,515,560 | ) | (2,087,798 | ) | (5,142,699 | ) | (4,033,028 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Interest income | 2,025 | 5,186 | 2,567 | 11,313 | ||||||||||||

| Interest expense | (10,460 | ) | (22,249 | ) | (25,945 | ) | (45,799 | ) | ||||||||

| Other income | 38,053 | 1 | 38,055 | 4,511 | ||||||||||||

| Other expense | (483,043 | ) | — | (492,685 | ) | — | ||||||||||

| Change in fair value of warrants issued | (1,062,818 | ) | — | (1,062,818 | ) | — | ||||||||||

| Total other income (expense), net | (1,516,243 | ) | (17,062 | ) | (1,540,826 | ) | (29,975 | ) | ||||||||

| Net loss before provision for income tax expense | (4,031,803 | ) | (2,104,860 | ) | (6,683,525 | ) | (4,063,003 | ) | ||||||||

| Income tax expense | 28,984 | 5,419 | 37,679 | 9,091 | ||||||||||||

| Net loss | $ | (4,060,787 | ) | $ | (2,110,279 | ) | $ | (6,721,204 | ) | $ | (4,072,094 | ) | ||||

| Net loss per common share, basic and diluted | $ | (0.17 | ) | $ | (0.19 | ) | $ | (0.20 | ) | $ | (0.38 | ) | ||||

| Weighted average common shares outstanding | 24,021,546 | 11,389,308 | 20,148,211 | 10,655,483 | ||||||||||||