Increased Demand, Expanded Insurance Coverage Drive Record Growth

SAN ANTONIO, Texas (March 31, 2025) – bioAffinity Technologies, Inc. (Nasdaq: BIAF; BIAFW), a biotechnology company focused on the need for noninvasive, accurate tests for the detection of early-stage lung cancer and other lung diseases, today reported financial results for the year ended December 31, 2024.

2024 Highlights

- Record Revenue: Revenue grew approximately 270% to $9.4 million in 2024, a significant increase from $2.5 million in 2023.

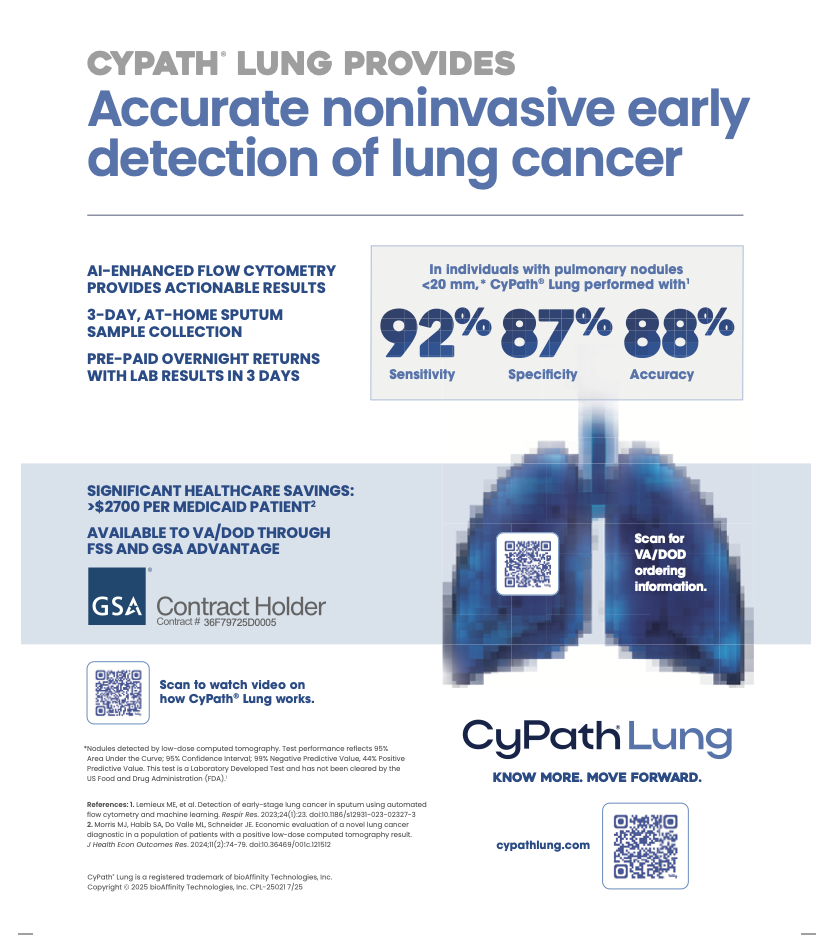

- Increased Demand: CyPath® Lung orders grew by approximately 1,400% over full-year 2023, reflecting increasing physician adoption.

- CyPath® Lung Reimbursed by Medicare and Private Insurance: The unique CPT code for CyPath® Lung was added to the Centers for Medicare and Medicaid Services (CMS) 2024 clinical laboratory schedule effective January 1, leading to reimbursement of the test by both Medicare and private insurers.

- Expanded Physician Network: Number of physician offices signed increased by over 300% in 2024, positioning the Company for continued growth in 2025.

- Federal Supply Schedule (FSS) Listing: In October 2024, CyPath® Lung was added to the U.S. Federal Supply Schedule, granting Veterans Health Administration and Military Health System facilities streamlined access to the test. Through 1,380 government healthcare facilities, Veterans at high risk for developing lung cancer can now benefit from CyPath® Lung.

- Economic Validation: A study published in the Journal of Health Economics and Outcomes Research concluded that adding CyPath® Lung to the standard of care for Medicare patients with a positive lung cancer screening could have saved an average of $2,773 per patient, amounting to $379 million in total cost savings in 2022. The savings for private insurance patients would have been even greater, an average of $6,460 per patient, an estimated total savings of $895 million if all individuals screened in 2022 were covered by private insurance.

- Leadership Appointments: Appointed J. Michael Edwards, CPA, MBA, as Chief Financial Officer. He previously served bioAffinity Technologies as consulting Chief Financial Officer until 2023 and rejoined the management team to help oversee the long-term financial and strategic direction of the Company, including the ongoing commercialization of CyPath® Lung. Appointed William Bauta, PhD, as Chief Science Officer. Bauta joined bioAffinity Technologies as Senior Vice President in 2016. He previously served as Associate Director of Science at Genzyme.

- Innovation Pipeline Progress: Company scientists are developing diagnostic tests for Chronic Obstructive Pulmonary Disease (COPD) and asthma that build on our expertise in using sputum as a sample for flow cytometric analysis, including research to detect the presence of specific therapeutic targets to identify patients who can benefit from specific treatments.

- International Patent Recognition: Received a Certificate of Grant of Patent from the Japan Patent Office for the Company’s unique method using flow cytometry to predict the likelihood of lung disease, including CyPath® Lung’s application for early-stage lung cancer detection.

2025 Financial Outlook

The Company anticipates generating between $6 million to $8 million in total revenue in 2025, including $1 to $2 million from sales of CyPath lung tests. The reduction in revenue for the 2025 financial outlook as compared to 2024 is a result of discontinuing certain unprofitable pathology services, which will be more than offset by corresponding cost reductions from lower labor and overhead costs at our subsidiary laboratory.

Recent Events

- Case Studies: Released a series of patient case studies in collaboration with Gordon Downie, MD, PhD, Director of the Pulmonary Nodule Clinic at Titus Regional Medical Center in Texas. The studies illustrate the benefit of CyPath® Lung to both patients and clinicians, including earlier diagnosis of recurrent cancer and new primary lung cancer and avoiding unnecessary invasive procedures that carry risks for elderly patients with comorbidities.

- FDA Pivotal Study: Submitted protocol for a pivotal clinical trial to the Sterling Institutional Review Board (IRB). Academic, private, military, and VA medical centers have been qualified as collection sites for an estimated 3,500-patient clinical trial expected to open in the second quarter of 2025.

Management Commentary

“We are proud of the tremendous strides bioAffinity Technologies made in 2024, achieving record revenue and laying the groundwork for continued growth,” bioAffinity President and Chief Executive Officer Maria Zannes said. “The full-year integration of our pathology lab, Precision Pathology, and the growing adoption of CyPath® Lung reflect the success of our strategy to build a scalable, high-impact business focused on early lung cancer detection.”

“Our inclusion on the U.S. Federal Supply Schedule marks a major milestone, ensuring Veterans and military personnel across the country have easy access to CyPath® Lung,” Zannes continued. “Physician adoption is accelerating, driven by the clinical value and noninvasive nature of our test. Referrals and word-of-mouth continue to fuel our expansion beyond Texas, positioning us for sustained growth.”

“As we look to 2025, our focus remains on expanding commercial adoption of CyPath® Lung, strengthening our relationships with key opinion leaders, starting our FDA pivotal study, and advancing our pipeline of diagnostics powered by artificial intelligence and flow cytometry,” Zannes added. “With the recent streamlining of operations that will increase profitability at our laboratory, we are building a company with the science, strategy and leadership to shape the future of lung cancer diagnostics — and with every test ordered, we’re unlocking value for both patients and shareholders.”

2024 Financial Results

Revenue for the year ended December 31, 2024, was $9.4 million, compared with $2.5 million for the prior year. The increase was primarily driven by a full year of consolidated operations of Precision Pathology Laboratory Services, LLC (PPLS), which was acquired in September 2023. Revenue was primarily generated from patient service fees, including CyPath® Lung tests, and histology fees.

Operating expenses for 2024 totaled $18.3 million, compared with $10.5 million in 2023. The increase reflects the full-year impact of PPLS operations, higher sales and marketing activities, and increased general and administrative expenses associated with scaling commercial operations.

Direct costs and expenses were $6.0 million for 2024, up from $1.7 million in 2023, due to the inclusion of a full year of pathology and lab operations for PPLS. Research and development expenses remained level at approximately $1.5 million in both years, reflecting consistent investment in lab operations and preclinical development. Clinical development expenses also remained level at $0.3 million in both years. The Company expects to see an increase in clinical development expense in 2025, as enrollment begins for the FDA study.

Selling, general and administrative expenses were $9.9 million, compared with $6.8 million in 2023. The increase was mainly attributed to the expanded operations and personnel costs related to the commercialization of CyPath® Lung and a full year of operating PPLS.

Net loss for the year ended December 31, 2024, was $9.0 million, or $0.75 per share, compared with a net loss of $7.9 million, or $0.91 per share, for the prior year.

Cash and cash equivalents as of December 31, 2024, were $1.1 million, compared with $2.8 million as of December 31, 2023. Subsequent to the end of 2024, bioAffinity Technologies raised aggregate gross proceeds of $1.4 million through warrant exercises in February 2025.

About bioAffinity Technologies, Inc.

bioAffinity Technologies, Inc. addresses the need for noninvasive diagnosis of early-stage cancer and diseases of the lung and broad-spectrum cancer treatments. The Company’s first product, CyPath® Lung, is a noninvasive test that has shown high sensitivity, specificity and accuracy for the detection of early-stage lung cancer. CyPath® is marketed as a Laboratory Developed Test (LDT) by Precision Pathology Laboratory Services, a subsidiary of bioAffinity Technologies. For more information, visit www.bioaffinitytech.com.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates and assumptions and include statements regarding the increase in the number of physician offices signed positioning the Company for continued growth in 2025; healthcare cost savings from adding CyPath® Lung to the standard of care for Medicare and private insurance patients with a positive lung cancer screening; generating between $6 million to $8 million in total revenue in 2025, including $1 to $2 million from sales of CyPath lung tests; the reduction in revenue for the 2025 financial outlook as compared to 2024 being a result of discontinuing certain unprofitable pathology services, which will be more than offset by corresponding cost reductions from lower labor and overhead costs at our subsidiary laboratory; profitability at the laboratory increasing with the recent streamlining of operations; the Company having the science, strategy and leadership to shape the future of lung cancer diagnostics; and an expected increase in clinical development expense in 2025, as enrollment begins for the FDA study. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the ability of the Company to continue its growth in 2025; the ability to save costs by use of CyPath® Lung; the ability to generate between $6 million and $8 million in total revenue in 2025 and to offset a reduction in revenue for 2025 with cost savings; the ability to increase profitability at the laboratory; the ability to commence enrollment in the Company’s FDA study and the other factors discussed in the Company’s recent Annual Report on Form 10-K, and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. Such forward-looking statements are based on facts and conditions as they exist at the time such statements are made and predictions as to future facts and conditions. While the Company believes these forward-looking statements are reasonable, readers of this press release are cautioned not to place undue reliance on any forward-looking statements. The information in this release is provided only as of the date of this release, and the Company does not undertake any obligation to update any forward-looking statement relating to matters discussed in this press release, except as may be required by applicable securities laws.

Contacts

bioAffinity Technologies

Julie Anne Overton

Director of Communications

jao@bioaffinitytech.com

Investor Relations

Dave Gentry

RedChip Companies Inc.

1-800-RED-CHIP (733-2447) Or 407-491-4498

BIAF@redchip.com

bioAffinity Technologies, Inc.

Consolidated Balance Sheets

| December 31, | ||||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,105,291 | $ | 2,821,570 | ||||

| Accounts and other receivables, net | 1,139,204 | 811,674 | ||||||

| Inventory | 27,608 | 18,484 | ||||||

| Prepaid expenses and other current assets | 422,995 | 321,017 | ||||||

| Total current assets | 2,695,098 | 3,972,745 | ||||||

| Non-current assets: | ||||||||

| Property and equipment, net | 375,385 | 458,633 | ||||||

| Operating lease right-of-use asset, net | 463,011 | 370,312 | ||||||

| Finance lease right-of-use asset, net | 780,872 | 1,165,844 | ||||||

| Goodwill | 1,404,486 | 1,404,486 | ||||||

| Intangible assets, net | 775,139 | 833,472 | ||||||

| Other assets | 19,676 | 16,060 | ||||||

| Total assets | $ | 6,513,667 | $ | 8,221,552 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 987,311 | $ | 604,789 | ||||

| Accrued expenses | 1,398,722 | 1,149,811 | ||||||

| Unearned revenue | 24,404 | 33,058 | ||||||

| Operating lease liability, current portion | 127,498 | 94,708 | ||||||

| Finance lease liability, current portion | 395,301 | 365,463 | ||||||

| Notes payable, current portion | 171,669 | — | ||||||

| Total current liabilities | 3,104,905 | 2,247,829 | ||||||

| Non-current liabilities | ||||||||

| Operating lease liability, net of current portion | 342,098 | 283,001 | ||||||

| Finance lease liability, net of current portion | 444,448 | 835,467 | ||||||

| Notes payable, net of current portion | 20,180 | — | ||||||

| Total liabilities | 3,911,631 | 3,366,297 | ||||||

| Commitments and contingencies | – | – | ||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, no shares issued or outstanding at December 31, 2024 and 2023, respectively | — | — | ||||||

| Common stock, par value $0.007 per share; 100,000,000 shares authorized; 15,576,674 and 9,394,610 shares issued and outstanding as of December 31, 2024 and 2023, respectively | 106,593 | 65,762 | ||||||

| Additional paid-in capital | 56,139,753 | 49,393,972 | ||||||

| Accumulated deficit | (53,644,310 | ) | (44,604,479 | ) | ||||

| Total stockholders’ equity | 2,602,036 | 4,855,255 | ||||||

| Total liabilities, and stockholders’ equity | $ | 6,513,667 | $ | 8,221,552 | ||||

bioAffinity Technologies, Inc.

Consolidated Statements of Operations

| 2024 | 2023 | |||||||

| Net Revenue | $ | 9,362,022 | $ | 2,532,499 | ||||

| Operating expenses: | ||||||||

| Direct costs and expenses | 5,983,475 | 1,740,884 | ||||||

| Research and development | 1,461,227 | 1,467,936 | ||||||

| Clinical development | 321,655 | 256,661 | ||||||

| Selling, general and administrative | 9,943,473 | 6,790,654 | ||||||

| Depreciation and amortization | 605,637 | 249,592 | ||||||

| Total operating expenses | 18,315,467 | 10,505,727 | ||||||

| Loss from operations | (8,953,445 | ) | (7,973,228 | ) | ||||

| Other income (expense): | ||||||||

| Interest income | 17,610 | 122,131 | ||||||

| Interest expense | (92,475 | ) | (37,125 | ) | ||||

| Other income | 10,323 | 3,325 | ||||||

| Other expense | (10,194 | ) | (31,121 | ) | ||||

| Loss before income taxes | (9,028,181 | ) | (7,916,018 | ) | ||||

| Income tax expense | (11,650 | ) | (20,993 | ) | ||||

| Net loss | $ | (9,039,831 | ) | $ | (7,937,011 | ) | ||

| Net loss per common share, basic and diluted | $ | (0.75 | ) | $ | (0.91 | ) | ||

| Weighted average common shares outstanding | 12,125,029 | 8,747,509 | ||||||

# # #