As published in Mergermarket

By Deborah Balshem and Jeff Sheban

Summary

• Medicare reimbursement providing tailwinds

• Expansion into government market imminent

• Analyst sees labs chains among potential buyers

bioAffinity Technologies [NASDAQ:BIAF], a healthcare diagnostics company focused on cancer, would consider inbound approaches among financing options as it focuses on national expansion, two officials said.

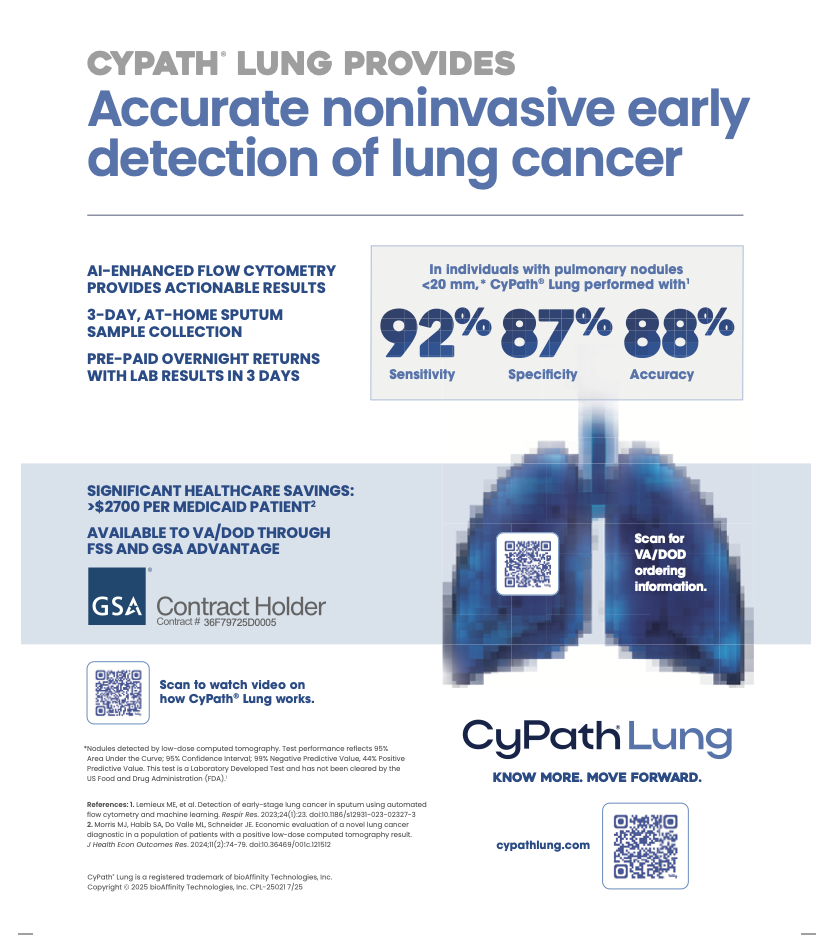

The company recently kicked off sales of its first product, CyPath Lung, an at-home, noninvasive lung cancer screening diagnostic tool that accurately diagnoses early-stage lung cancer, the leading cause of cancer deaths in the US for both men and women.

San Antonio, Texas-based bioAffinity began selling CyPath Lung in earnest at the start of this year, after receiving commercial and Medicare coverage, according to CEO Maria Zannes. The company is primarily targeting pulmonologists in Texas but has plans to expand nationally and start selling to the federal government, including the Department of Defense and Department of Veterans Affairs, later this year, she said.

bioAffinity CFO J. Michael Edwards, in the same interview, said the company “will continue to take advantage of the (public) markets as we can,” when asked about funding growth. “We would consider any financing options presented to the company,” such as licensing, co-development and revenue-sharing agreements, as well as inbound sale approaches, though Edwards said the business is not formally exploring such options.

Last week, bioAffinity announced the appointment of Edwards to the permanent CFO post. He became interim CFO in September and previously was bioAffinity’s consulting CFO from 2014 to 2023, overseeing its initial public offering.

Increasingly attractive to buyers

Lung cancer is often caught in the later stages and has a 28% survival rate after five years, according to Zannes. In contrast, prostate cancer, which is often caught in the earlier stages, has a 10-year survival rate of 98%, she said.

“If this test starts to take off, it would be natural” for strategics to show serious interest, said Anthony Vendetti, director of equity research for Maxim Group. Vendetti said bioAffinity could be seen as an attractive sale target now while acknowledging that some buyers may be less likely to bet on early-stage companies today.

Vendetti said logical acquirers are lab companies such as Quest Diagnostics [NYSE:DGX] and Labcorp [NYSE:LH]. Molecular diagnostics company Exact Sciences [NASDAQ:EXAS], maker of the Cologuard at-home colon cancer screening test, might also show interest as a way to expand into other indications, he added.

Zannes noted other possible buyers as medical device and diagnostics companies in the lung space such as Pulmonx [NASDAQ:LUNG], Siemens [FWB:SIE] and Olympus [TYO:7733].

Using machine learning and automated analysis, CyPath Lung assists clinical decision-making in lung cancer patients whose low-dose computed tomography (LDCT) has demonstrated a suspicious finding.

Flow cytometry is used to analyze the micro-environment of the lung and detect how the presence of cancer changes that lung environment, Zannes explained.

LDCT, the current protocol for screening people at high risk for lung cancer to identify nodules in the lungs, has a low positive predictive value that can lead to unnecessary invasive procedures, she added. For every 100 people who receive positive LDCT results, only four have lung cancer, according to a recent National Lung Cancer screening trial of 53,000 patients.

With CyPath Lung’s at-home sample collection kit, patients use a simple noninvasive assist device that breaks up mucus in the lung to cough up a sputum sample over three days and overnight it to the lab.

The test lists for USD 1,900. A recent peer-reviewed study showed that integrating CyPath Lung into standard care could save Medicare an average of USD 2,773 per patient, with a total potential savings of USD 379m in 2022. For private-payer patients, the savings average USD 6,460 per patient.

Other indications in pipeline

In September 2023, bioAffinity acquired the laboratory assets of Precision Pathology Laboratory Services for USD 3.5m in cash and stock. The company is now focused on organic growth and the development of additional tests in areas such as asthma and chronic obstructive pulmonary disease (COPD), Zannes said.

bioAffinity raised USD 7.86m in its September 2022 IPO. The debt-free company generated total

revenue of USD 2.5m in 2023 and USD 2.4m in 2Q24. It is forecasting 2024 revenue of more than USD 9.6m for the Precision lab subsidiary, according to bioAffinity’s 2Q24 earnings report.

In August, bioAffinity announced the pricing of a USD 1.75m registered direct offering and concurrent private placement and warrant inducement. The company had cash and cash equivalents of USD 801,000, according to its August 2024 10-Q filing. Its market cap is approximately USD 26m.

There is a dwindling number of companies in the nodule management space, as determining malignancy is difficult, Zannes said. She noted one peer as Biodesix [NASDAQ:BDSX], which sells Nodify Lung, a nodule risk assessment test that uses blood drawn from patients.

bioAffinity has approximately 95 employees. The company uses law firm Blank Rome and accounting firm Withum.

—————–

Mergermarket provides growth strategy insights, and forward-looking M&A intelligence and data to investment banks, private equity firms, lenders, law firms, accounting firms and corporates via our 500+ worldwide journalists. Our parent company, ION Group, is a global leader in trading and workflow automation software, high-value analytics and insights, and strategic consulting.